Why planning feels frustrating when it ignores real constraints and how reality-based planning restores usefulness...

READ MORE

"A building is only as good as its foundation. Let us help you lay a solid foundation for your business."

Lanetta Allen, Founder

Date: January 23, 2024

Beneficial ownership information refers to identifying information about the individuals who directly or indirectly own or control a company.

Financial Crimes Enforcement Network (FinCen)

Beneficial ownership information reporting refers to the process of disclosing and documenting the individuals who ultimately own or control a legal entity, such as a company. This practice is essential for several reasons, including the prevention of money laundering, the fight against corruption, and the promotion of transparency within financial systems. Governments and regulatory bodies worldwide recognize the significance of unveiling the true owners of legal entities to curb illicit financial activities.

What is the Corporate Transparency Act (CTA)?

The Corporate Transparency Act (CTA) is a legislative measure in the United States, enacted as part of the National Defense Authorization Act (NDAA) for Fiscal Year 2021. The primary objective of the CTA is to bolster transparency and counter the misuse of anonymous shell companies in activities such as money laundering, terrorist financing, and other financial crimes. Enacted on January 1, 2021, the CTA marks a substantial advancement in the improvement of beneficial ownership reporting practices within the United States.

Here are some key aspects related to beneficial ownership information reporting in the United States:

1. Applicability:

The CTA applies to most U.S. legal entities, including corporations, limited liability companies (LLCs), and other similar entities. Some entities, such as publicly traded companies and certain regulated entities, are exempt.

A beneficial owner is an individual who, directly or indirectly, exercises substantial control over the entity or owns or controls at least 25% of the ownership interests.

Covered entities are required to report beneficial ownership information to the Financial Crimes Enforcement Network (FinCEN), which is a bureau of the U.S. Department of the Treasury.

The reported information typically includes the full legal name, date of birth, current address, and a unique identifying number (e.g., driver’s license or passport number) of each beneficial owner.

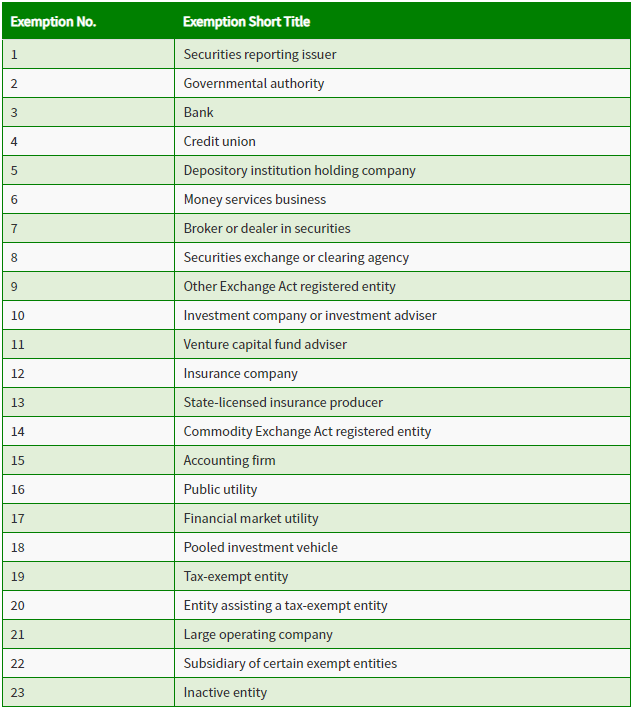

4. Exemptions:

Certain entities are exempt from the reporting requirements, including publicly traded companies, certain financial institutions, and entities already subject to substantial reporting requirements, such as those regulated by the Securities and Exchange Commission (SEC). Here’s a summary of the exemptions retrieved from FinCen’s website. Access the Small Entitity Compliance Guide to see if your company meets an exemption.

5. Filing Deadlines:

A reporting company established or registered for business prior to January 1, 2024, is granted until January 1, 2025, to submit its initial report on beneficial ownership information (BOI).

For reporting companies established or registered between January 1, 2024, and January 1, 2025, a 90-calendar day window is provided from the time the company is officially notified of its creation or registration effectiveness, or from the first public notice issued by a secretary of state or equivalent office, whichever occurs earlier.

Companies established or registered after January 1, 2025, are required to file their initial BOI reports with FinCEN within 30 calendar days from the actual notice or public acknowledgment of the company’s creation or registration becoming effective.

6. Access to Information:

The information collected by the Financial Crimes Enforcement Network (FinCEN) is not publicly disclosed. However, per its official website, “FinCEN will permit Federal, State, local, and Tribal officials, as well as certain foreign officials who submit a request through a U.S. Federal government agency, to obtain beneficial ownership information for authorized activities related to national security, intelligence, and law enforcement. Financial institutions will have access to beneficial ownership information in certain circumstances, with the consent of the reporting company. Those financial institutions’ regulators will also have access to beneficial ownership information when they supervise the financial institutions.”

7. Penalties for Non-Compliance:

Non-compliance with the reporting requirements can result in civil and criminal penalties, including fines and imprisonment.

8. Ongoing Compliance Monitoring:

Entities subject to the CTA should stay informed about the rulemaking process, be aware of filing deadlines, and monitor any additional guidance provided by FinCEN to ensure ongoing compliance.

As regulatory requirements may evolve, it is advisable to consult legal and compliance professionals to get the most up-to-date and accurate information regarding beneficial ownership reporting in the United States. Additionally, checking the official FinCEN website and other relevant government sources for the latest updates is recommended.

Why planning feels frustrating when it ignores real constraints and how reality-based planning restores usefulness...

READ MOREHow strong foundations restore focus, reduce friction, and help leaders regain momentum.

READ MOREWhy focus feels impossible when leadership foundations are weak and how unclear priorities, roles, and...

READ MORE